Contact us

Clear communication, Expert advice and Personalised Support.

Phone

Ph. 07 5522 6172

Mob. 0423 007 828

Email Sharon Barnes at:

sharon@pureconveyancing.com.au

Location

U 5,6/1 Sands St, Tweed Heads NSW

PO Box 883 Currumbin QLD 4223

(By Appoinment Only)

Get in touch

I would love to hear from you.

I understand the process can be a little daunting. Don’t worry, I have you covered. Please fill out the form below and let me know how I can help.

When purchasing or selling property, numerous questions arise.

Below, we’ve compiled some of the common questions our clients often ask.

What sort of Conveyancing does Pure Conveyancing do?

Conveyancing is the process of transferring the property into the name of the new registered owner and all the tasks associated with the legal transfer.

We look after Residential property transfers for either a sale or purchase with a Real Estate Agent as well as Private sales or purchases without a Real Estate Agent. We also look after Conveyancing for Transfers in accordance with Court orders prepared by Family lawyers.

We also look after Transfers between related parties for example if you would like to purchase a property from your sibling or if you would like to be registered on the Certificate of Title with your spouse.

Please note that we do not look after Off the Plan or Commercial properties, Business Sales, or Retirement Home transactions, however we can refer you to a suitable legal representative who specialises in each of those transactions.

What should I look for when choosing a Conveyancer?

A Conveyancer is a property transfer specialist. Sharon at Pure Conveyancing is a Licensed Certified Practicing Conveyancer registered with the Office of Fair Trading and is a Member of the Australian Institute of Conveyancers with full Professional Indemnity insurance.

Experience is incredibly important because there is so much that can and needs to occur during the transaction and because Sharon has over 30 years’ experience, she knows how to be 10 steps ahead of other participants in the transaction (lenders, mortgage brokers, other legal representatives, real estate agents), by coordinating them and making sure that they have undertaken their tasks, within their roles, ensuring delays do not occur without warning, or at the last moment, prior to settlement.

Do I need a Solicitor when I appoint Pure Conveyancing?

When we are arranging Conveyancing for NSW transactions, you do not need a Solicitor as we are legal representatives in New South Wales.

When we are looking after Queensland Conveyancing you do need a Solicitor to oversee your transaction, however, we arrange the Solicitor for your Queensland sale or purchase on your behalf, so that you do not have to appoint one separately.

If you need specific legal advice which is outside Conveyancing work, such as Family Law, Wills, Estates and Litigation, we work with the right local Solicitors and Lawyers who are specialists in their fields of law, so that we can refer you to the perfect professional to help you.

Do you contact me during the Conveyancing?

Sharon at Pure Conveyancing understands that you need to feel that you are always listened to and be understood on what you need when you are selling or purchasing your property. Sharon provides fast communication, which is streamlined and clear, by email and correspondence and telephone and mobile text without confusing legal jargon. You will receive regular updates and have a seamless, stress-free service from the first contact to settlement completion. Conveyancing is a complicated process, and you don’t want the heavy burden of chasing up whether your legal representative has done a task or followed something up for you, when they promised to do so.

When you need to call us, we have a 24/7 Australian telephone receptionist service to take your message which is immediately text and emailed to Sharon so she can respond to you personally without delay.

Can I use Pure Conveyancing if I live interstate or overseas?

Pure Conveyancing can look after your Conveyancing if you live interstate anywhere in Australia or are overseas on holiday, when you are selling or buying property.

However, you must have an email address with good internet connection, be available to communicate with us during the transaction and you must be either be an Australian Citizen or Permanent Resident of Australia.

We arrange a Virtual Identity process and use DocuSign for electronic signatures.

Please note that to reduce our legal obligated risks in the Conveyancing profession, we do not look after Foreign Residents of Australia for selling or purchasing property.

What is a cooling off period?

In NSW and QLD there is a 5-business day cooling off period for a purchaser (buyer) only in residential Conveyancing contracts.

The seller (vendor) does not have a cooling off period (unless a specific condition has been written to specify one).

If the purchaser decides to terminate the contract under the cooling off period, then they must forfeit 0.25% of the purchase price to the seller.

Please note that cooling off periods are not available when purchasing at Auction and in some circumstances in NSW transactions, the seller will ask the purchaser to waive the cooling off period if they have been provided other special conditions in the Contract such as due diligence, pest and building and finance conditions.

We sign the cooling off waiver on your behalf for NSW and the Real Estate Agent will prepare the Cooling off waiver for Queensland contracts. We will never sign a waiver unless you have given us written authority to do so. Sometimes Queensland Agents may provide the waiver amongst the Contract documents to sign, so that is why it is important to have your Queensland contract reviewed before you sign in case you sign a waiver to the cooling off period without understanding what the document means.

What is transfer duty?

Transfer duty used to be called stamp duty and most people understand that terminology but means the same thing. It is a state government tax applied to the transfer in a property purchase and is calculated on the purchase price. NSW and QLD each have their own calculations of duty shown on their own respective websites with calculators.

We do provide you with the specific cost of the Transfer duty applicable to the purchase when we provide our Cost Agreement to you.

If you are eligible for the First Home duty concession (NSW and QLD) or Home duty concession (QLD only), we prepare and complete the statutory declaration documents for you to sign. We then apply and process the relevant concession amount for you to be paid at settlement.

In NSW Transfer duty is payable no later than 3 months from the contract date (signing date) and in QLD, no later than 30 days from the Contract becoming unconditional, otherwise penalty interest applies and will be calculated and paid at settlement. We calculate the penalty interest for you and will show you the amount owed for duty in the settlement calculations.

If I am purchasing a property, when does the property title transfer to my name?

Settlements are arranged in PEXA (Property Exchange Australia) and the lodging of the Transfer to register your name on Title (or the Company name you have nominated on the Contract) is arranged immediately electronically in PEXA after completion of settlement. If you have used a lender for finance, then they shall register their Mortgage on Title at the same time as the transfer of name registration.

What sort of searches does a Conveyancer undertake when purchasing a property?

As your Conveyancer at Pure Conveyancing, for NSW and QLD, I investigate how much money is owed for Council rates, water rates, body corporate/strata fees and land tax by the seller, as these expenses ‘run’ and stay with the property which means that if you purchased a property with outstanding amounts owing to these authorities, then you will be liable to pay them after settlement as the new owner.

Regarding other investigative searches, I provide you with a detailed booklet to choose from. There are many searches that can be undertaken to investigate many different things and would cost thousands of dollars if you chose all of them. It is dependant on what you want to investigate and what you want to find out, so you need to let us know what your intentions are for the property and why you are purchasing it. These discussions are best before you sign a Contract because some searches take considerable time to receive a result.

Do I need to consider home insurance?

If you are selling property, we recommend that you maintain your current home insurance right up until the time of settlement.

If you are purchasing in QLD, you must insure the property from contract date (when contract is signed regardless of the contract still conditional upon completing a condition).

If you are purchasing in NSW, you should pre-arrange insurance before settlement because if you are using a lender, they will want you to include them as security on the policy, so generally arrange insurance when the contract is unconditional, or when lender requests the certificate of currency but definitely from settlement date.

If purchasing a body corporate or strata unit, the building is usually covered under a collective body corporate/strata insurance however you must obtain contents insurance and additional landlord insurance if you are leasing out the property.

To ensure that all will be smooth in the case of something going wrong between signing the Contract and settlement, a prompt current home insurance policy is best to arrange as soon as possible to protect you against all sorts of accidental damage and legal liability.

How long is contract signing until settlement completion?

In NSW and QLD, settlement date is negotiated between the parties with the Real Estate Agent or in private sales, between each party together. Generally, settlements are 30, 42, 45 or 60 days from the Contract date (from when the Contract is signed).

We can bring settlement forward by mutual agreement once the Contract has been signed.

Pure Conveyancing will request the amendment to the other party on your behalf. Changes will then be made to settlement in the PEXA workspace so other participants such as the lenders will be informed.

What happens if either party cannot settle on the due date of the contract?

This might seem a simple question to receive a simple answer, however the contract is a legal document with terms, conditions, and dates that both parties have agreed to abide by, so it is dependent on the circumstances of the Contract.

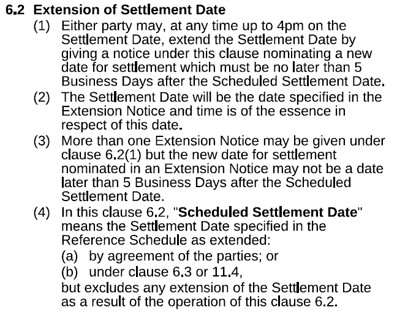

Any changes to the settlement date must be communicated between legal representatives. In QLD there is general clause 6.2, which allows either party to extend the settlement date up to 5 business days. This is the clause here:

In NSW, it is not a time of the essence contract, so extensions of settlement completion can be sought to either party, however a purchaser will have to pay penalty interest to the seller, which is generally 10% per annum, on the amount owed to the seller, calculated daily, payable at settlement.

Either party can issue a Notice to Complete, which puts the other party on legal notice to settle strictly within 14 days of the Notice date.

Settlement extensions can be complicated legal processes and your Conveyancer, Sharon at Pure Conveyancing, will guide you on the specifics related to your particular contract if a settlement extension is going to be required from either party.

When do I pay for the property, the other costs and Conveyancing?

As a purchaser, you pay a deposit for the property to the Real Estate Agent’s trust account and in the case of a private sale, to a Trust Account nominated by either the seller or purchaser to their respective legal representatives.

In NSW, the deposit is usually 10% of the purchase price, however, can be negotiated to be reduced to 5% of the purchase price.

In Queensland, deposits are negotiated with varying amounts and the Contract can provide an initial deposit, and a balance of deposit payable and will state when these amounts are to be paid.

For both sellers and purchaser clients, we provide a detailed Costs Agreement explaining what Conveyancing professional fees, and what itemised disbursements and Government payments that you need to pay.

We issue you a first billing professional fee payable before settlement and this is because we undertake quite a significant amount of work before you sign a Contract, when you have signed the Contract and during the stage of completion of your special conditions to the unconditional stage. The balance of the property purchase is paid at settlement. The balance of our fees and disbursements and government costs are paid at settlement.

How are Conveyancing professional fees calculated?

We can give you a total of an estimate of professional fees and outlays (disbursements) by telephone or email when you initially contact us, however it is not until we have reviewed the Contract for a purchaser and in the case for a seller, fully understand what work we are expected to undertake, when we can provide you with a full written quotation.

Our professional fees start at $1,500 plus gst and will be clearly communicated to you in a Costs Agreement that we both sign, so there are no surprises at settlement.

The professional costs differ because if depends on the type of property that you are selling or purchasing, if you require any specific special conditions, or any unusual requirements.

Disbursements are costs that we pay on your behalf such as searches and investigations which we pass on to you to pay in our invoice as a total. Searches are depending on what is required for each individual property, so that is why we itemise each disbursement required, so we are transparent to you on what needs to be obtained and each itemised cost.

Are there any additional costs for additional work that you complete during the Conveyancing?

When signing a Contract as a legal document, it is expected that all parties will abide by the due dates and everything will be smooth with satisfactory pest and building reports and finance approved before the due dates, the tenants have vacated before settlement and the property is perfect condition and empty with the inclusions/chattels intact and left at the property before settlement.

However, in some circumstances, and unfortunately more often that we would like, there comes situations which need urgent attention, communication, negotiation and resolving.

On our Costs Agreement you will be provided with a table of an example of itemised scenarios that could occur with set professional fees.

We find that a set cost is a fair way of providing you with the peace of mind service that you need in the time of a change which can feel stressful, and needs resolving and attended to urgently, instead of charging an unknown hourly rate that you will not know when it ends, to a final exploited amount.

What are settlement adjustments?

At settlement, we arrange adjustments in a Settlement Adjustment Sheet which shows the sale/purchase price of the property, less the deposit paid, then the adjusted amount owed by either the seller or the buyer for council rates, water rates, body corporate/strata levies, discharge of mortgage land titles office fee, payment for strata search, rent payments overpaid by a tenant to be reimbursed to the purchaser, and anything else that was negotiated to be paid by either party to the other. We prepare and provide the Settlement Adjustment Sheet to both parties before settlement.

Council rates are paid in advance to the current rating period.

In NSW, the rating period will usually be financial year, so you will pay pro-rata council rates in advance in the settlement statement from settlement date to 30 June that same financial year.

In QLD, the rating period will usually be 6 monthly/half yearly, so you will pay pro-rata council rates in advance in the settlement statement from settlement date to either 30 June or 31 December that calendar year.

Body Corporate/Strata levies are paid in advance to the current rating levy period which will be shown on the relevant search result particular to the property.

When you are calculating amounts that you need for settlement, you need to ensure that you are allowing advance payment of council rates and if you are purchasing a unit – body corporate/strata levies.

Regarding water and sewerage fees and water usage, it is dependent on the council/water authority however generally we have the seller allow a credit to the purchaser in the Adjustment Sheet because we have applied and received a special meter reading and we calculate applicable amounts right up to settlement date. As the purchaser has been allowed a credit, then they will have to pay the amounts that will then be shown on the next water account provided to them after settlement.

Electronic Conveyancing still requires Personal Service

When I started my career in Conveyancing in the 1990's, my work dealing with...

Attention Taylor Swift Fans!

With the much admired entrepreneur Taylor Swift phenomena reaching dizzying...

Cheaper is not always the best, when choosing a Conveyancer.

Choosing the cheapest Conveyancer may not be the best solution for several...